Builders

Offer Reverse Mortgage for Purchase (H4P) Financing & Expand Your Clientele

Offer Reverse Mortgage for Purchase (H4P) Financing & Expand Your Clientele

You may have heard of reverse mortgage loans for existing homes, but did you know that people can buy new homes—and that includes new construction—with these loans? Rob and the Kanyur Reverse Team can help you open new doors to buyers 62 and older.

30% More Upgrades

HECM buyers of new construction are 30% more likely to purchase add-ons and upgrades.

Better Positioning

Offering financing specifically for retirees shows your commitment to the community.

Target Audience

Many retirees are leaving older homes that need repairs—new homes are very attractive!

It Can Be a Great Deal for the Buyer

Especially since 2014, reverse mortgage loans (Home Equity Conversion Mortgages, or “HECMs”) have become highly regulated by the federal government and are among the safest loans around. The bad press you might have heard is likely from people who haven’t kept up with the news. Here are some of the top benefits for retirees.

Tax-Free Money From Home Equity*

No Mandatory Monthly Mortgage Payments

(Must still pay taxes and insurance and maintain the home)

They Remain Sole Owner of the Home

Payment Only Due When They Leave the Home

View Qualifying Conditions

- One spouse must be 62 years or older to be eligible for a reverse mortgage. In Texas, both spouses must be 62 years or older

- The property must be a single-family home, a 2 to a 4-unit dwelling or an FHA-approved condo

- Must receive reverse mortgage counseling from a HUD-approved counseling agency

- The home must be a primary residence (live there 6+ months per year)

- Must meet minimal credit and property requirements

- Must not be delinquent on any federal debt

Why the Kanyur Reverse Team Should Be Your Go-To Partner

Rob is a Certified Continuing Education Instructor at ASREB (Arizona School of Real Estate & Business) and SAAR (Scottsdale Area Association of Realtors) and has helped countless realtors better serve the 62+ demographic. As your partner, we can also provide you with: customized marketing materials, customized video content about your properties and educational seminars for your sales team.

Purchase Power

Here’s how it works. With a reverse mortgage loan for purchase (H4P), your client sells their existing home. They then take out a reverse mortgage on the home they wish to purchase and combine that with the proceeds of their home sale to cover the down payment (along with additional funds, if necessary).

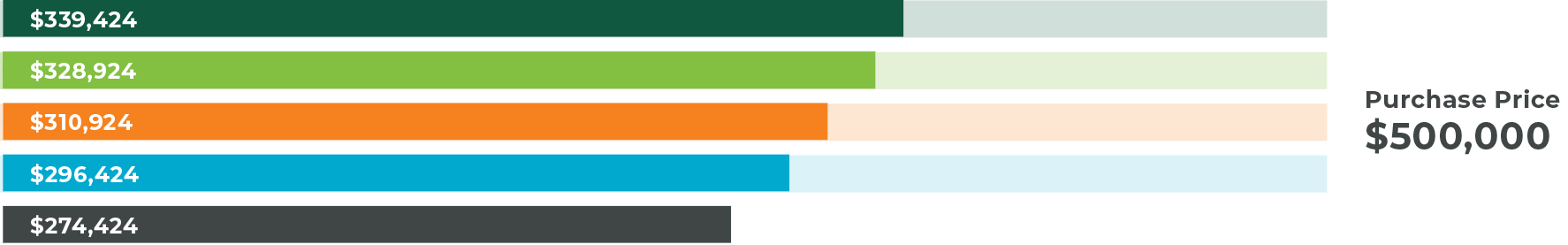

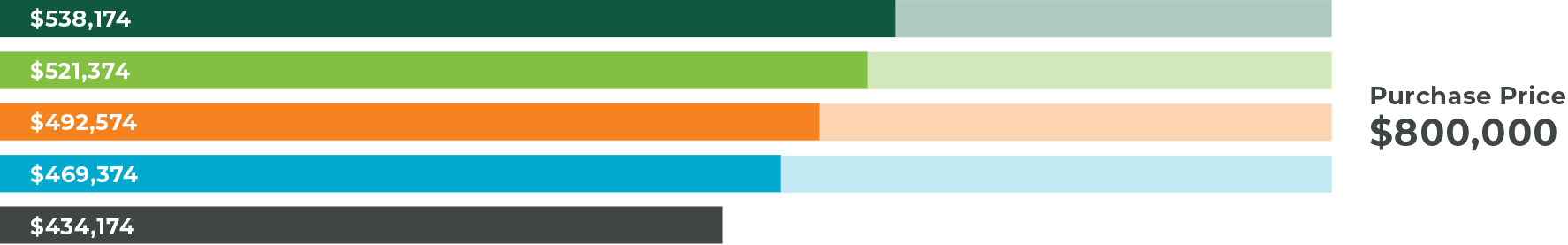

Estimated Cash From Borrower*

Age of Youngest Borrower

Faded portion of bar represents the estimated reverse mortgage funds

Then What Happens?

Your client enjoys the same terms for any home with a reverse mortgage loan:

Want To Learn More About Reverse Mortgage Loans in General?

Our Video Series for Builders

Learn What You Need To Know About Reverse Mortgages.

What Is a “Reverse” Mortgage Loan or HECM?

Reverse Mortgage Loan Myths and Misunderstandings

Building a New Home With a Reverse Mortgage Loan

The “WHY” for Home Builders – Buying Power

Why Partner With Fairway Independent Mortgage Corporation?

Let’s Help Seniors Buy New Homes

Fill out this form and we’ll reach out ASAP!

*This advertisement does not constitute tax and/or financial advice from Fairway.