REVERSE MORTGAGE FOR PURCHASE LOAN (H4P)

The Homebuying Loan Made for Fixed Incomes

Many retirees would love to move, but think they either would have to downsize, drain their savings or start a new mortgage. The Home Equity Conversion Mortgage (HECM) for Purchase loan (H4P) can boost your homebuying power while protecting your retirement assets. Let Rob and the Kanyur Reverse Team show you how it works.

How the H4P Works

Down Payment

The product allows you to combine a down payment from your own funds (e.g., proceeds from the sale of your current home) with the proceeds from the HECM for Purchase (H4P) loan to complete the purchase. The amount that you would be required to put down is roughly 40%-60% percent of the sales price of the home you are buying. The required down payment is determined by the age of the youngest borrower the current interest rates, and the purchase price of the new home.

Repayment Flexibility

You have the option to repay as much or as little of the loan balance each month as you would like, or you can make no monthly mortgages payments at all. The FHA guarantees that as long as you meet your loan obligations (which include maintaining the home and paying for property taxes and homeowners insurance), no repayment of the loan is required until the last borrower moves out or passes away. When the loan becomes due, you or your estate has up to 12 months to repay the loan balance, which is typically achieved by selling the home.

Key Benefits

An H4P Can Potentially Help You To:

- Increase your purchasing power to buy the home you really want

- Free up cash flow — you will not be obligated to make monthly mortgage payments. You still must maintain the home and pay taxes and homeowners insurance

- Extend the life of your productive retirement assets*

- Qualify for a mortgage in retirement — there are minimal income and credit requirements

Eligibility

- You must be 62 or older

- You must meet minimal credit and property requirements

- You must receive reverse mortgage counseling from a HUD-approved counseling agency

- You must not be delinquent on any federal debt

- Home must be a primary residence

- Property must be a single-family home, a 2- to 4-unit dwelling or an FHA-approved condo

Increase Your Purchasing Power

With a H4P loan, you sell your existing home. You then take out a reverse mortgage loan on the home you wish to purchase and combine that with the proceeds of your home sale to cover the down payment, along with additional funds if necessary.

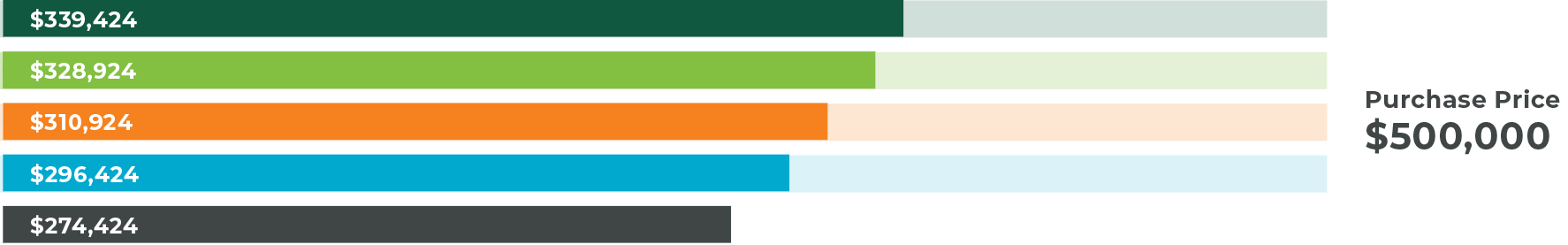

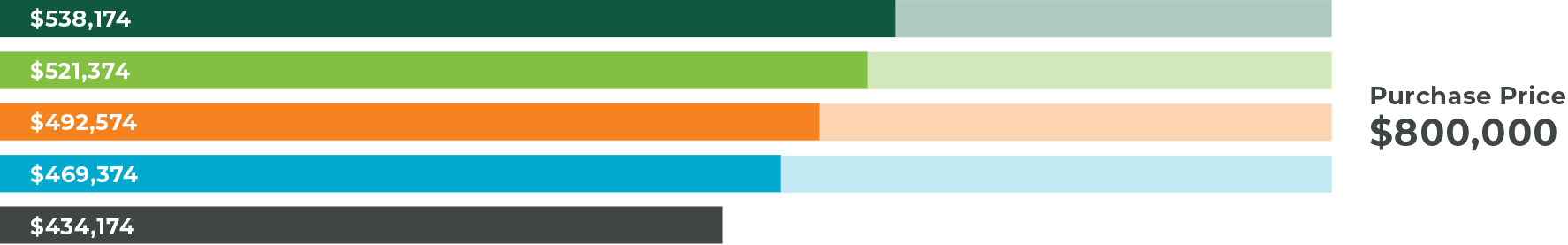

Estimated Cash From Borrower*

Age of Youngest Borrower

Faded portion of bar represents the estimated Reverse Mortgage funds.

This information is provided as a guideline and does not reflect the final outcome for any particular homebuyer or property. The actual Reverse Mortgage available funds are based on current interest rates, current charges associated with loan, borrower date of birth (or non-borrowing spouse, if applicable), the property sales price and standard closing cost. Interest rates and loan fees are subject to change without notice. Following the closing of the home purchase, no further principal or interest payments will be required as long as one borrower occupies the home as their primary residence and adheres to all HUD guidelines of loan. Borrower must remain current on property taxes, homeowner’s insurance (and homeowner association dues, if applicable), and home must be maintained.

Who’s a Great Fit for a Reverse for Purchase Loan?

The following are just a couple examples of people who found the living situation that’s best for their golden years. Houses and stories are for illustration purposes only. Houses may not be available for purchase.

Moving to the Perfect Neighborhood

James and Mary, 62 and 59, want to move to a newly constructed home in an area that’s ideal for retirees. The problem is that home values are close to double in the new community compared to where they live currently. With a reverse mortgage for purchase, James and Mary can make their move and never have to make monthly mortgage payments again. They just have to pay property expenses and maintain the home.

$600,000 Home Sale Value

James and Mary currently own this home.

$800,000 Home Value

With a reverse mortgage for purchase, the proceeds from their old home could enable them to buy their much more expensive dream home.

Planning for a Legacy*

Cindy, 62, is selling her current home that she owns free and clear. She wants a home of a similar value that is closer to her grandchildren—but she also wants to set up an annuity for her grandchildren to help pay for college.* A reverse mortgage can allow her to purchase the home she wants and have plenty of money left over from the sale of her current house.

$800,000 Home Sale Value

Cindy currently owns this home.

$650,000 Home Value

With a reverse mortgage for purchase, Cindy could sell her current house for $800,000 and buy a $650,000 house. She would have ~$360,000 remaining to use. $170,000 could go to an annuity for her grandkids and $190,000 could be invested by her financial advisor.* She would also never have to make monthly mortgage payments again. She would just have to take care of property charges like taxes, insurance and upkeep.

Curious About What You May Qualify For?

Fill out this short form and we’ll reach out ASAP!

*This advertisement does not constitute tax or financial advice. Please consult a tax and/or financial advisor regarding your specific situation.