Real Estate Professionals

Help Retirees Maximize Their Purchasing Power

With your help and the Kanyur Reverse Team, retirees can increase their homebuying power up to 200% — without having to pay monthly mortgage payments. Instead, they simply have to cover property charges like taxes, insurance and upkeep.

How It Works

Many retirees would like to move, but some are still making mortgage payments, and others are fixed owning their home outright.

With a reverse mortgage loan for purchase (also called HECM for purchase loan), your client sells their existing home. They then take out a reverse mortgage on the homes they wish to purchase and combine that with the proceeds of their home sale to cover the down payment (along with additional funds if necessary).

Hear From a Real H4P Client

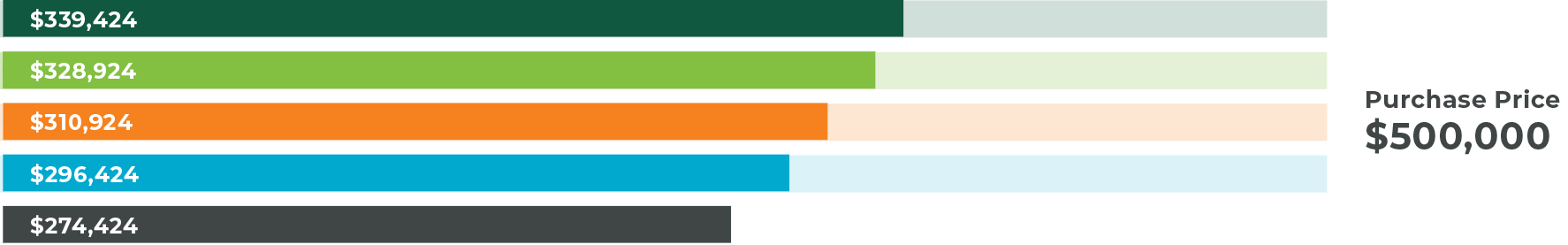

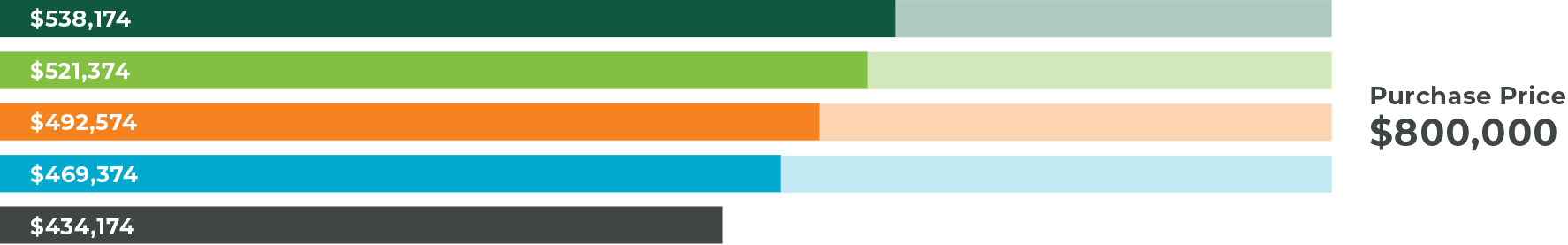

Estimated Cash From Borrower*

Age of Youngest Borrower

Faded portion of bar represents the estimated Reverse Mortgage funds.

This information is provided as a guideline and does not reflect the final outcome for any particular homebuyer or property. The actual Reverse Mortgage available funds are based on current interest rates, current charges associated with loan, borrower date of birth (or non-borrowing spouse, if applicable), the property sales price and standard closing cost. Interest rates and loan fees are subject to change without notice. Following the closing of the home purchase, no further principal or interest payments will be required as long as one borrower occupies the home as their primary residence and adheres to all HUD guidelines of loan. Borrower must remain current on property taxes, homeowner’s insurance (and homeowner association dues, if applicable), and home must be maintained.

Then What Happens?

Your client enjoys the same terms for any home with a reverse mortgage loan:

Who’s a Great Fit for a Reverse for Purchase Loan?

Folks who want to retire in a bigger, nicer home than they could otherwise purchase.

Folks who want to move to a more expensive area than they currently live in.

Folks who want to move to an equivalent home, but want significant cash-flow afterward.

Folks who still have monthly mortgage payments that they want to end ASAP.

View Qualifying Conditions

- One spouse must be 62 or older to be eligible for a reverse mortgage. In Texas, both spouses must be 62 or older

- The property must be a single-family home, a 2 to a 4-unit dwelling or an FHA-approved condo

- Must receive reverse mortgage counseling from a HUD-approved counseling agency

- The home must be a primary residence (live there 6+ months per year)

- Must meet minimal credit and property requirements

- Must not be delinquent on any federal debt

Frequently Asked Questions About…

Reverse Mortgages for Purchase

When a home is purchased with a reverse mortgage, will the loan be held on the existing home or the newly purchased home?

The reverse mortgage will be held on the newly purchased home as the primary residence. The down payment needed at closing is usually between 30%-70%.

Why is the down payment higher with a reverse mortgage?

The down payment is higher initially because the buyer will not be required to make monthly mortgage payments (except for taxes and insurance, and the home must be maintained). The advantage in cash flow over the years, combined with the ability to purchase a more expensive home, can more than justify the difference for many homebuyers.

How will the lender determine how much money is needed at closing?

The required down payment on the new home is determined by a number of factors, including the age or eligible non-borrowing spouse’s age (if applicable), current interest rates and the lesser of the home’s appraised value or purchase price.

What sources of funds (money) are allowed with the purchase of a home with a reverse mortgage?

The money must come from liquid assets (bank accounts, CDs, retirement accounts, etc.) or from the documented sale of other assets like the existing home.

Why the Kanyur Reverse Team Should Be Your Go-To Partner

Rob is a Certified Continuing Education Instructor at ASREB (Arizona School of Real Estate & Business) and SAAR (Scottsdale Area Association of Realtors) and has helped countless realtors better serve the 62+ demographic.

Hear Real H4P Customer Experiences

Choosing a Reverse Mortgage Over a Traditional Mortgage

Using a HECM for Purchase To Buy the Home You Really Want

Living in a House You Love While Creating a Legacy

Curious About What You May Qualify For?

Fill out this form and we’ll reach out ASAP!

*This advertisement does not constitute tax and/or financial advice from Fairway.